The Trapdoor blog is an insight into the author’s research in developing this exciting novel. Some pages from the original storybook are included in the blog with occasional handwritten notations.

The blogs allow the reader, if they choose, to move between the book and research within the blogs, by clicking on the links and delving into the material to enhance experience of locations and plots within the novel. (Images in the blog are place markers only.)

CHAPTER 13

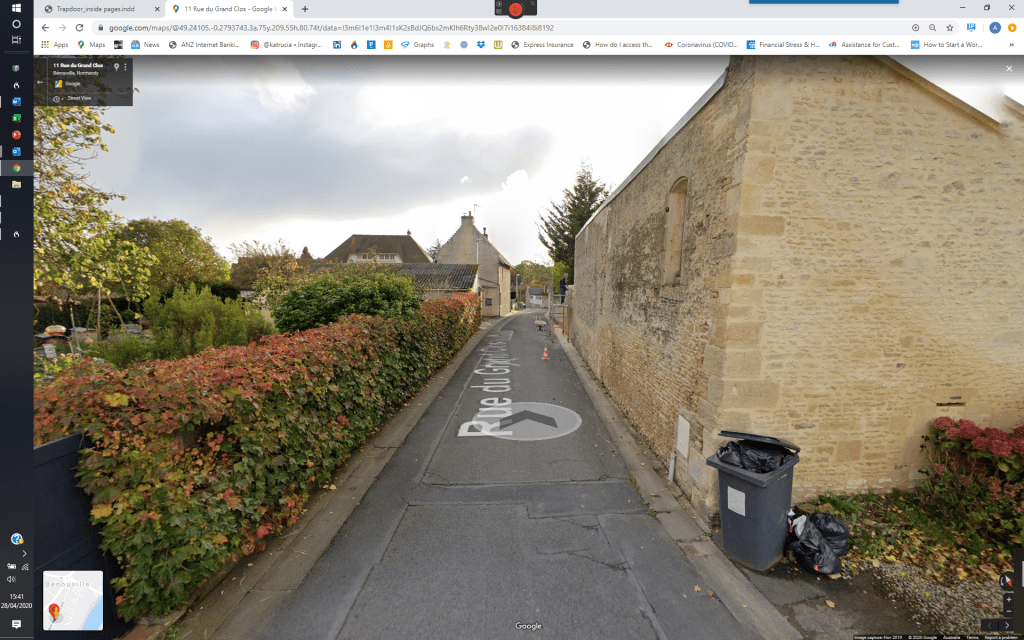

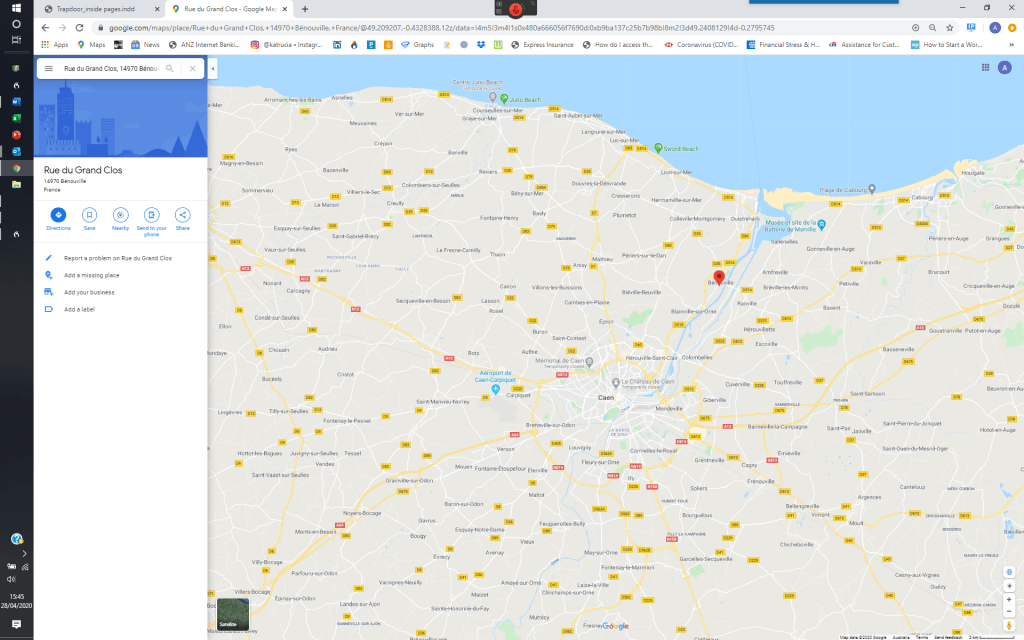

Benouville, with its access to the sea, had been chosen. An easily fortified set of renovated old warehouses with a centre courtyard and high fences on the Rue du Grand Clos had been purchased

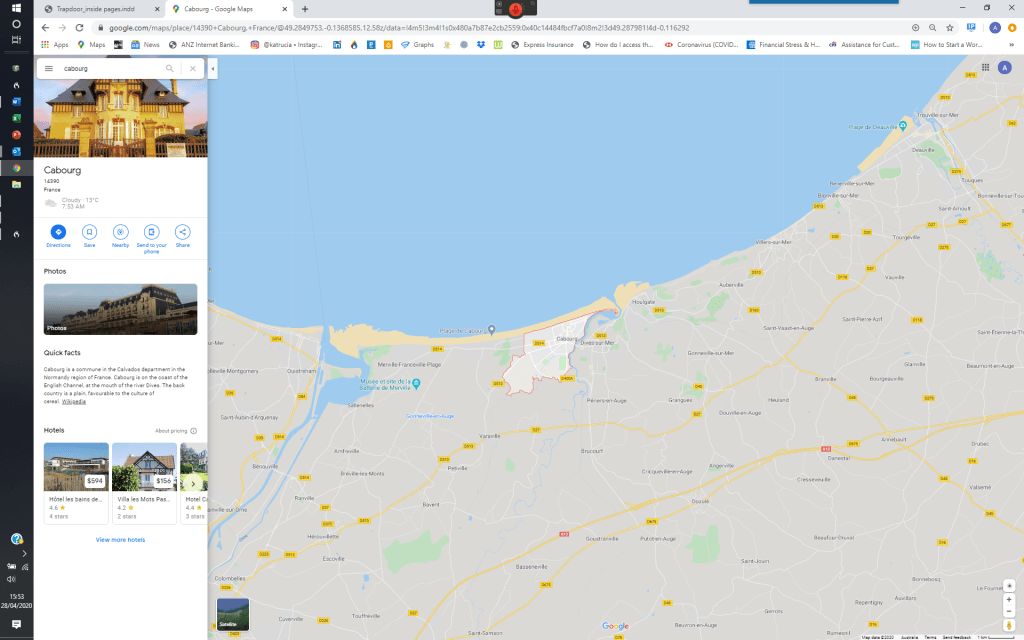

An emergency retreat in the form of a holiday house had been purchased at Cabourg to the north-east

Forty foot oceangoing cabin cruiser

Pump action shotgun M4 assault rifle

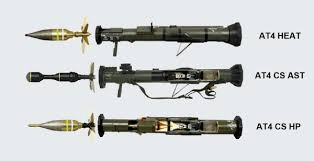

M25 sniper rifle AT4 rocket launcher

Private berth close to the Ouistreham Container Port and Deepwater channels.

Maritime Gendarmerie

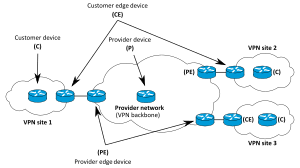

VPN

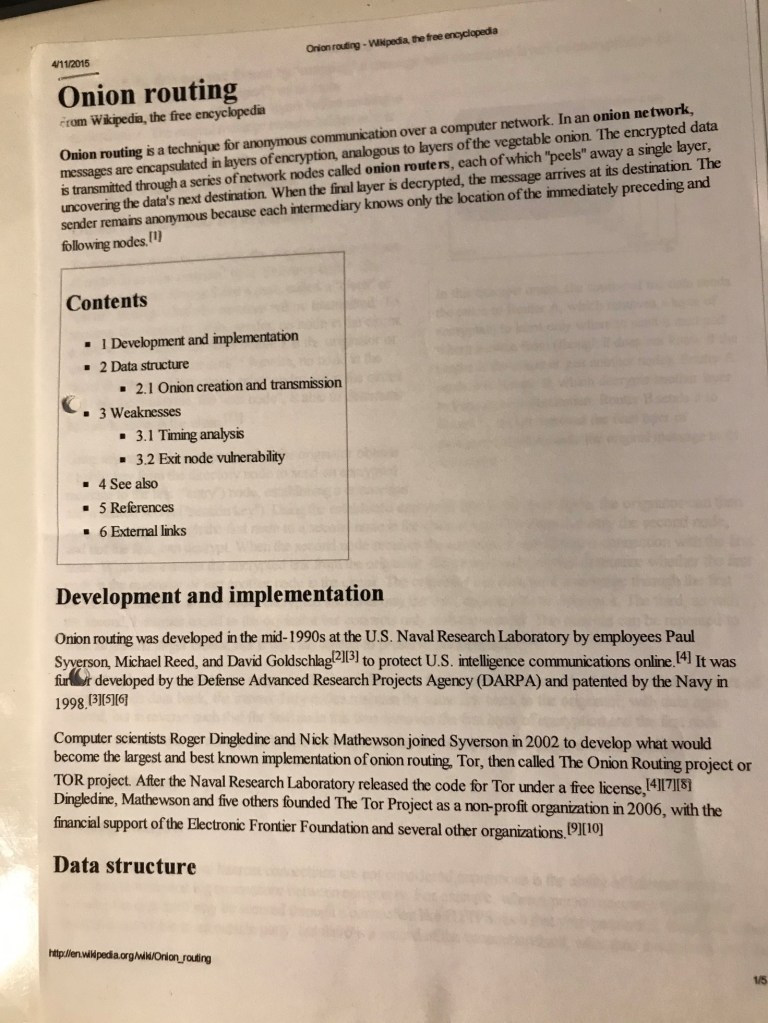

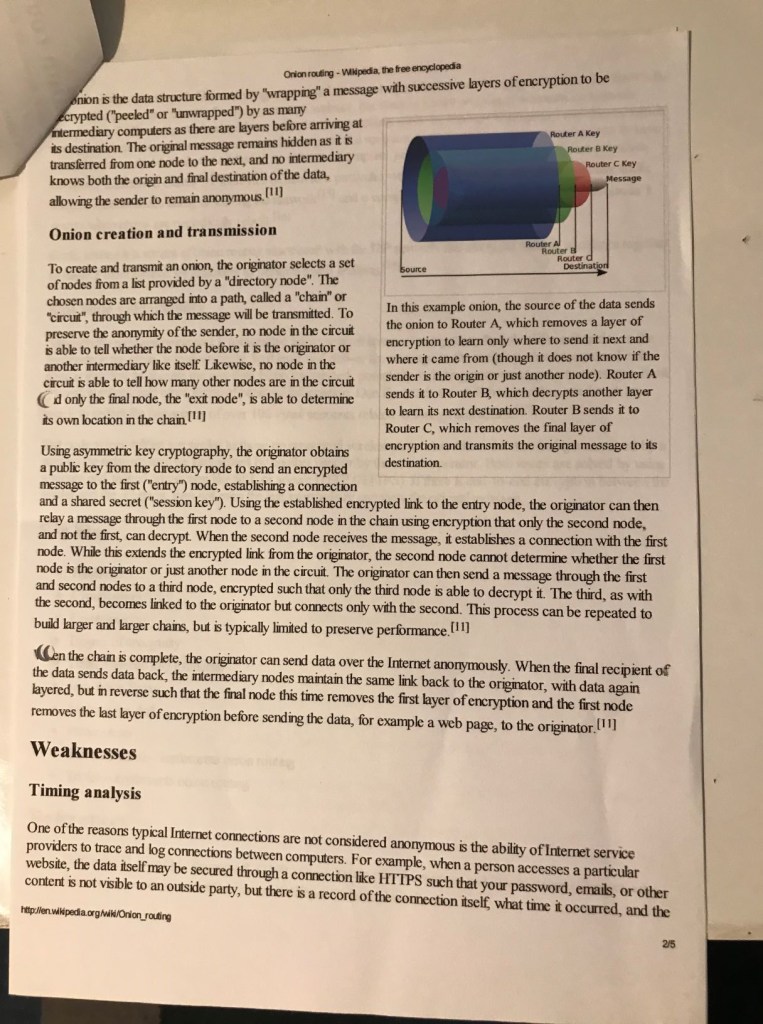

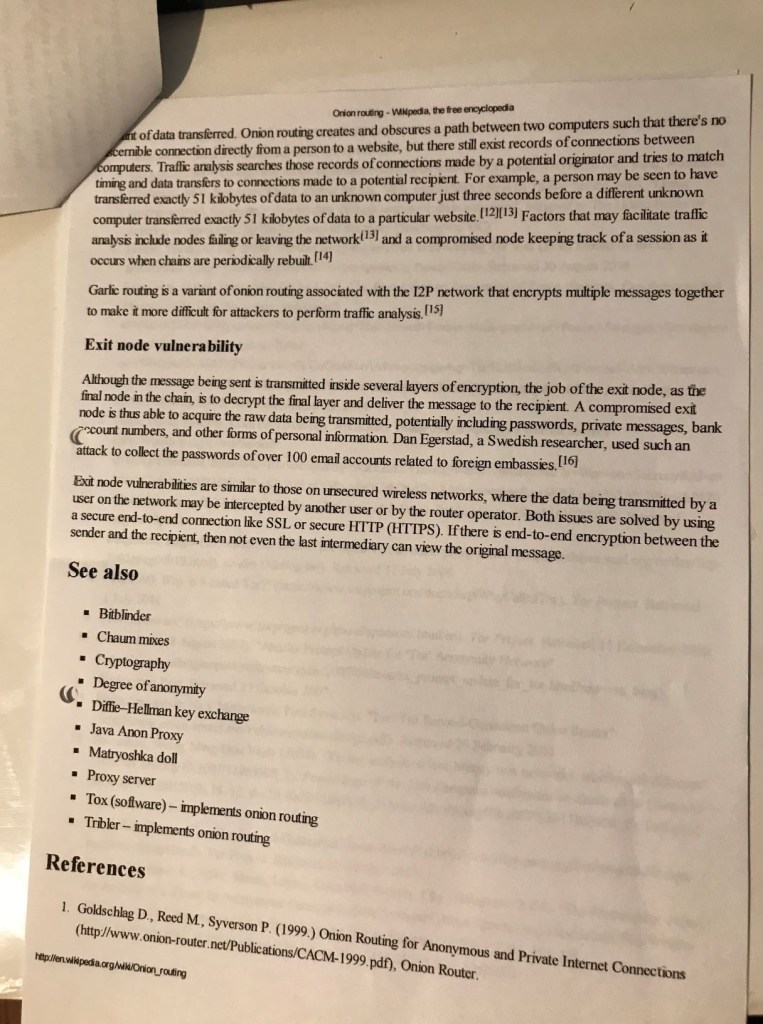

Onion routing

Original story book files

Encryption

Australian compulsory superannuation.

Using Australia’s economy as a comparison and projecting their planned self-funded retirement to a global level had been where the financial house of cards, so to speak, came tumbling down.

Four hundred million people in Asia striving to become middle class over the next ten years.

Meeting the demand of self-funded retirees and other pension-type plans meant that unless there was sufficient double-digit GDP growth, there was not going to be enough investment opportunities to meet demand.

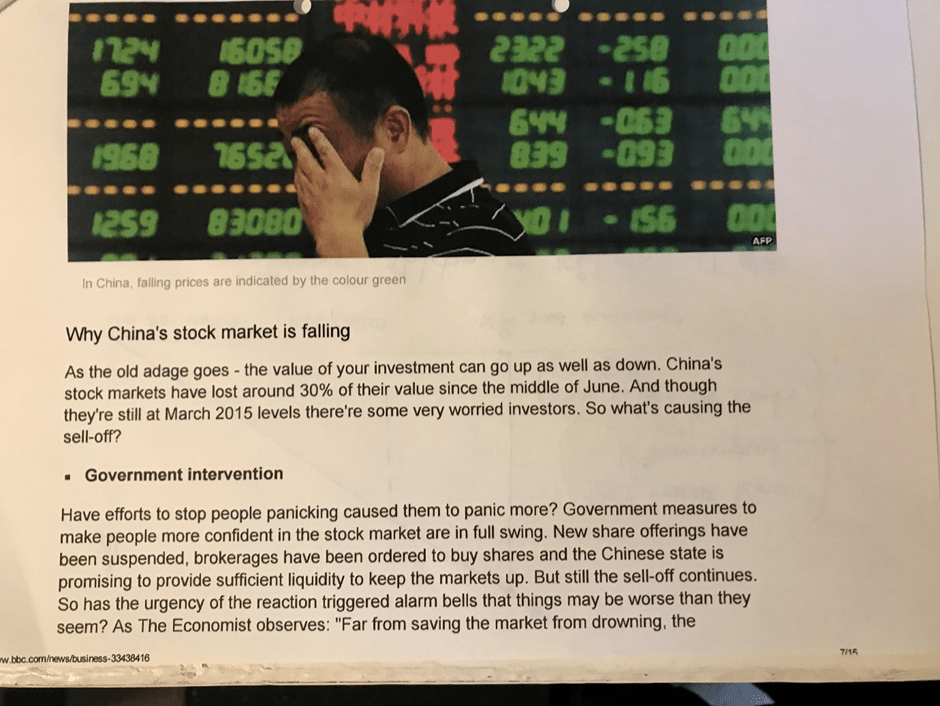

( Note and this is Just China)

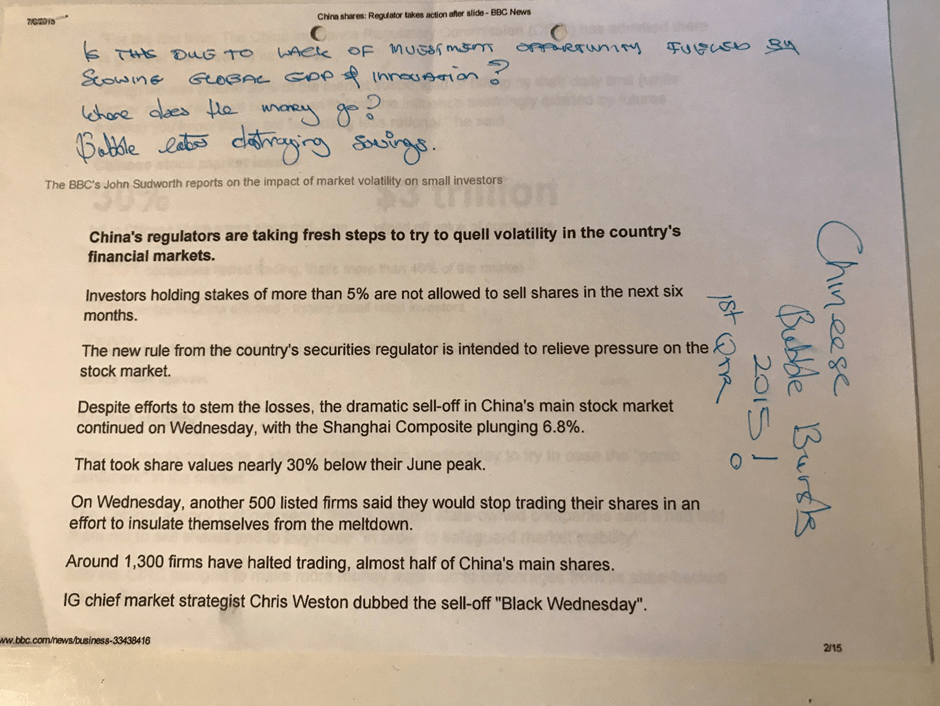

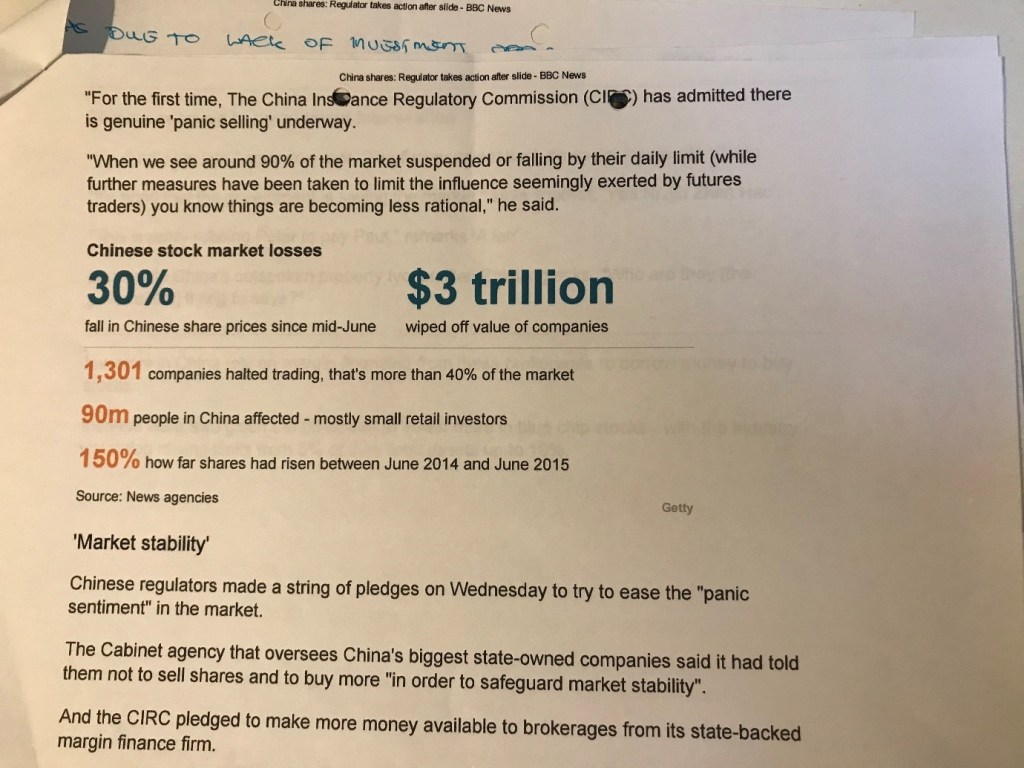

This had best been exemplified by the massive growth of the Chinese market value, then its tumble in the third quarter of 2015.

Similarly, the instability in the share markets could be driven

by overpricing due to the lack of new and emerging ‘secure

investment opportunities’. This had best been exemplified by

the massive growth of the Chinese market value, then its tumble

in the third quarter of 2015.

Possibly another story hiding in this, the page above on the global collateral accounts almost appears to be another novel in itself! was relevant to the story plot at the time but heavy reading. AndrewD

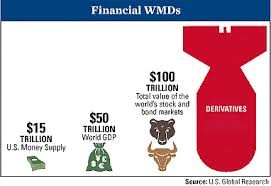

In drawing the paper to its close, she had a brief mention of the $710 trillion derivatives market. She had emphasized the report’s concern of the virtual nature of this market and its

huge size. It currently dwarfed the real global GDP in size by a factor estimated to be between ten and one hundred. The banks were the predominant market players; with banks being ‘safe investments’, the underlying risk to retirement incomes was not obvious to the public. The $710 trillion dollar question then becomes, ‘How secure is our retirement investment income?’

The $710 trillion dollar question then becomes, ‘How secure is our retirement investment income?’

FAST FORWARD TO 2020

How Big Is the Derivatives Market? The derivatives market is, in a word, gigantic—often estimated at over $1 quadrillion on the high end.Apr 28, 2020

IS IT STABLE?

WHAT IS ITS VALUE BASED ON?

Isn’t it component value? so was talking about the “sub prime crash” talking about the flea on the dog? Being instrumental in bringing the dog down? Looking at the images above, the dog in the picture is derivatives the rest of the financial weapons of mass destruction, are stocks and bonds, GDP, money supply, they look like the tail on the dog. After that it down to fleas and ticks and the like. ( small irritating stuff that is highly visible, easy to talk about, but possibly irrelevant, like the subprime market!) This stuff is out of my league but it appears to be logical! 🙂 AndrewD